Dealing with significant debt can feel overwhelming, and the thought of how to tackle it brings up a lot of questions. One common solution is a debt management program (DMP), but many people worry about the consequences. A major concern is; will debt management ruin my credit? The answer isn’t a simple yes or no. A DMP can affect your ...

Personal finance mistakes are one of the biggest reasons many people work hard yet remain financially stressed year after year. Earning money alone does not guarantee financial stability or wealth. What truly matters is how money is managed, saved, invested, and protected over time. Unfortunately, certain financial habits quietly drain income, block wealth creation, and keep people trapped in a ...

Saving money quickly often gets a bad reputation. Many people assume it means cutting out everything fun, living on instant noodles, and constantly feeling restricted. In reality, the most effective savings strategies don’t rely on deprivation. They focus on smarter choices, better systems, and small behavior shifts that free up cash without making life miserable. When done right, you ...

Creating a personal finance plan that actually works is one of the most powerful steps you can take toward long-term financial stability and freedom. Many people try budgeting apps, savings challenges, or investment tips, but without a clear, structured personal finance plan, these efforts often fail. A working finance plan is realistic, flexible, and aligned with your real-life goals, not ...

Let’s be honest – everything costs more these days. Your weekly grocery shop probably makes your wallet weep, and don’t get me started on petrol prices. If you’re like most Aussies right now, you’re probably wondering how to squeeze a few extra dollars out of each week without working yourself into the ground. Good news, mate. Side hustles aren’t just ...

Rising grocery bills, petrol costs, and rent increases got you feeling the pinch? You’re definitely not alone, mate. With the cost of living soaring across Australia, more people than ever are looking for ways to boost their income without giving up their day job. Whether you’re trying to cover those weekly grocery runs or save for something special, a solid ...

Emergency Fund Basics for Aussies; Your Complete Guide to Financial Security You know that gut-wrenching moment when your car breaks down and the mechanic quotes you $2,800 for repairs? Or when your employer announces redundancies and you suddenly wonder how you’d pay rent if your name was on the list? That sinking feeling in your stomach isn’t just stress about ...

Jane, a financial adviser from Melbourne with over 15 years of experience helping Australian families make smarter money decisions. When I’m not crunching numbers for clients, you’ll find me testing side hustles, exploring investment strategies, and yes filling out surveys while my kids demolish whatever’s left in the pantry. Right, so here’s something I never thought I’d be writing about, ...

How a simple conversation with your payroll department could add tens of thousands to your retirement nest egg Picture this: You’re sitting across from your financial advisor, and they casually mention that you could’ve saved thousands in tax while building your super balance — if only you’d known about salary sacrificing. Sound familiar? After fifteen years helping Australian families navigate ...

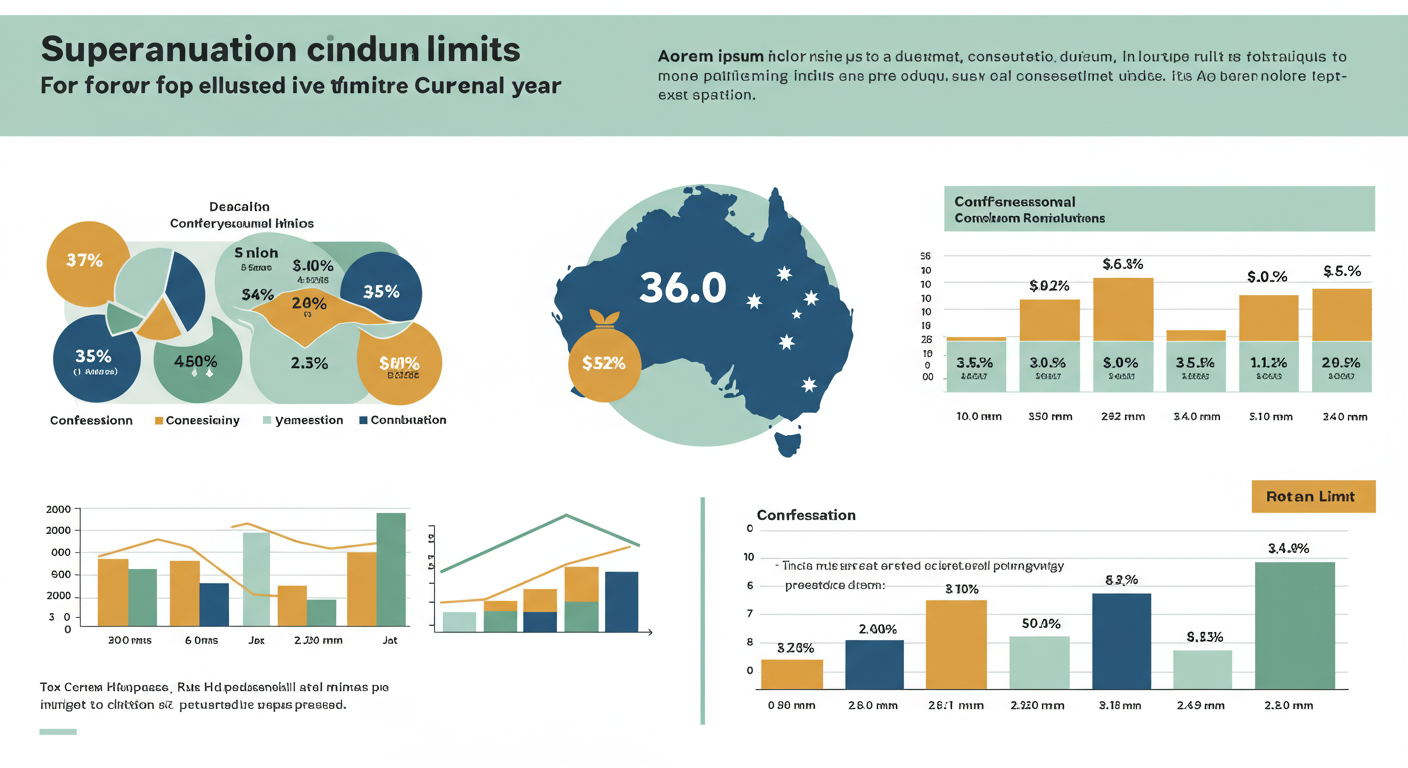

Your retirement nest egg doesn’t have to be a mystery. Here’s everything you need to know about superannuation contribution limits to secure your family’s financial future. After 20 years helping Australian families navigate their retirement planning, I’ve seen too many people treat super like a “set and forget” investment. That’s a costly mistake that could mean the difference between a ...